Diminishing value depreciation formula accounting

Net national product NNP is the total value of finished goods and services produced by a countrys citizens overseas and domestically minus depreciation. Record asset acquisition.

Depreciation Formula Examples With Excel Template

AS 10 specifies the accounting treatment for Property Plant and Equipment to stakeholders to understand investment made by the business in such assets.

. Diminishing balance or Written down value or Reducing balance Method. Plugging these figures into the diminishing value depreciation rate formula gives the following depreciation expense. The same formula is used to calculate the scrap value of an.

Written Down or Diminishing Balance Method. Quickly acquire feedback and results to find out how well you did. Cost of machine 100000 Estimated life of the asset 9 years Depreciation Written Down Value 10 pa.

Still in the article we will discuss two depreciation methods that are normally used to calculate depreciation for the entity fixed assets and how accumulated depreciation is related to the. 2000 - 500 x 30 percent 450 Year 2. More How National Income Accounting Works.

Purchases machinery worth 100000. Base year in relation to an income year has the meaning given by sections 45-320 and 45-470 in Schedule 1 to the Taxation Administration Act 1953. Reducing Balance Method Formula.

It is an accelerated method of calculating depreciation that depreciates the assets rapidly. The template accommodates depreciation calculations based on the straight-line diminishing value and double diminishing value calculation methods on a monthly or even a daily basis. Estimation of Value Added Value added is the difference between value of output of an enterprise and the value of its intermediate consumption non-factor inputs.

In other words when depreciation during the effective life of the machine is deducted from Cost of machinery we get the Salvage. It is an internal analysis metric used by the organizations along with the accounting profits. Read more yellow line starts to.

Here we discuss to calculate Marginal Utility with the example calculator and excel template. After the initial decrease the marginal cost Marginal Cost Marginal cost formula helps in calculating the value of increase or decrease of the total production cost of the company during the period under consideration if there is a change in output by one extra unit. Vector Cross Product Formula.

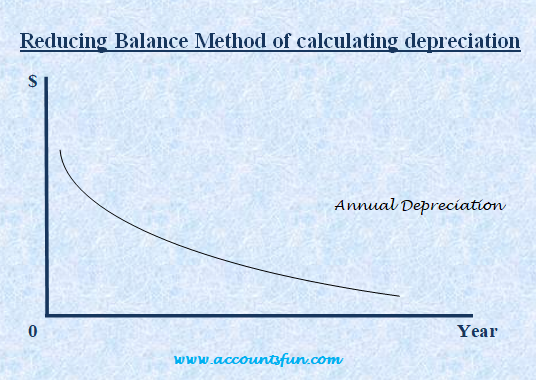

According to Reducing Balance Method the percentage at which depreciation is charged remains fixed and the amount of depreciation goes on diminishing year after year. Value added may be of the following kinds. Step two - Subtract depreciation charge from current asset value to get the remaining balance.

Depreciation expense Book value of the asset at the beginning of the year x Rate of depreciation. It is called an accounting identity or identity for short. Value added Value of output- Value of non-factor input Value of Output Sales Change in stock CS OS 34.

Balance value then will be used as asset value for next year and new balance value will be calculated to be used in the year after that and so on. Depreciation fracCost of asset Residual valueUseful life Rate of depreciation fracAmount of depreciationOriginal cost of asset x 100. Guide to Marginal Utility Formula.

The formula to find the median varies based on the total number of observations. The balance sheet identity states. Curious about how well you grasp a specific concept within economics.

Enter the email address you signed up with and well email you a reset link. Thus formula for calculating depreciation expense as per this method is as follows. In chapter 6 of Sandeep Garg Solutions Class 11 Economics students will learn how to find out the median of a given dataset.

Base value of a depreciating asset has the meaning given by subsection. Under this method we charge a fixed percentage of depreciation on the reducing balance of the asset. Depreciation The loss in value of a form of wealth that occurs either through use wear and tear or the passage of time obsolescence.

1550 - 500 x 30 percent 315. Accounting for depreciation is a vital procedure for companies. Q7 Salvage value means a Definite sale price of the asset b Cash to be received when life of the asset ends c Cash to be paid when asset is disposed off d Estimated disposal value.

Net worth is accumulated savings over. The value of particular machinery any manufacturing machine engineering machine vehicles etc after its effective life of usage is known as Salvage value. In this method the companies calculate depreciation based on the diminishing value of the asset.

Effective Annual Rate Formula. It is calculated by dividing the change in the costs by the change in quantity. A declining balance method is a common depreciation-calculation system that involves applying the depreciation rate against the non-depreciated balance.

Basic assessable income has the meaning given by subsection 392-452. This way they are able to record their assets at their current market values. Economic value added EVA is the economic profit Economic Profit Economic profit refers to the income acquired after deducting the opportunity and explicit costs from the business revenue ie total income minus overall expenses.

Economic Value Added EVA concept. The decrease in the value of a fixed asset due to its usages over time is called depreciation. The formula to find the median for an even number of observations is different from that for an odd number of observations.

All about the Percentage Depreciation Calculator. Declining Balance Method. Balance 3000 - 300 2700.

Compile a basic fixed asset register with limited user input. Automatically calculates monthly year-to-date. Depreciation is calculated under diminishing balance method based on a Original value b Book value c Scrap value d None of them.

Salvage Value Formula Calculator. Depreciation Expense Book value of asset at beginning of the year x Rate of Depreciation100. There are many depreciation methods that the entities could use.

Written Down Value Method Formula Using the same example as above Unreal Corp. This method considers a varying value of depreciation each year based on the deterioration of the asset. Heres the expression for the formula.

Basic concessional contributions cap means the concessional. 103 Impatience and the diminishing marginal returns to consumption.

Depreciation Schedule Formula And Calculator Excel Template

Depreciation Schedule Formula And Calculator Excel Template

Straight Line Depreciation Formula Guide To Calculate Depreciation

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

Depreciation Accounting Declining Balance Method With Partial Period Allocation Youtube

Straight Line Vs Reducing Balance Depreciation Youtube

Declining Balance Depreciation Calculator

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

Depreciation Formula Calculate Depreciation Expense

Depreciation Basics Accounting For Depreciation Youtube

Written Down Value Method Of Depreciation Calculation

Method To Get Straight Line Depreciation Formula Bench Accounting

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

Depreciation Rate Formula Examples How To Calculate

Depreciation Calculation

Accumulated Depreciation Definition Formula Calculation